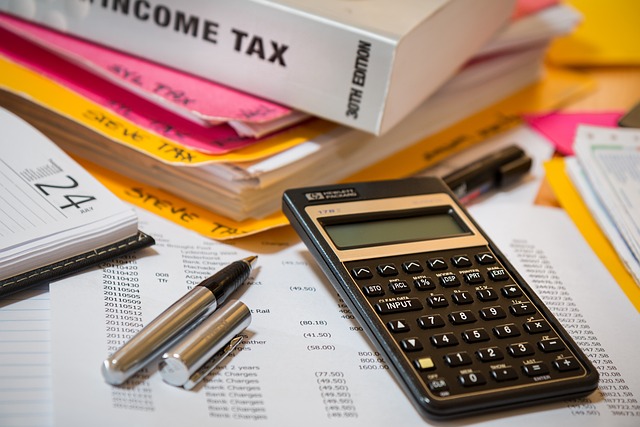

Offshore tax planning is a strategic method for individuals and businesses aiming Building A Secure Financial Future. By leveraging complex international tax laws, this approach legally reduces tax liabilities, protects assets, manages risks, and enhances wealth growth. Utilizing legal entities like offshore trusts or companies allows navigation through diverse global fiscal landscapes to take advantage of favorable tax regimes, contributing to long-term sustainable wealth accumulation.

Offshore tax planning is a powerful strategy for individuals and businesses seeking to build a secure financial future. By leveraging global opportunities, you can optimize your wealth growth sustainably. This article explores how understanding offshore tax planning can unlock significant advantages, enabling you to maximize tax benefits and navigate complex fiscal landscapes effectively. Discover practical strategies to ensure long-term financial security through strategic offshore investments and planning.

- Understanding Offshore Tax Planning: Unlocking Global Opportunities

- Strategies for Sustainable Wealth Growth: Maximizing Offshore Tax Benefits

Understanding Offshore Tax Planning: Unlocking Global Opportunities

Offshore tax planning is a strategic approach that allows individuals and businesses to optimize their fiscal positions, enabling them to build a secure financial future. By leveraging global opportunities, one can legally reduce their tax liabilities and enhance overall wealth growth. This strategy involves understanding complex international tax laws and utilizing various legal entities, such as offshore trusts or companies, to mitigate tax burdens.

In today’s interconnected world, effective offshore tax planning offers a way to navigate the intricate fiscal landscapes of different countries. It empowers individuals to protect their assets, manage risks, and take advantage of favorable tax regimes, ultimately contributing to sustainable wealth growth over time.

Strategies for Sustainable Wealth Growth: Maximizing Offshore Tax Benefits

Building a secure financial future often involves strategic planning, and offshore tax planning is a powerful tool in this pursuit. By leveraging the benefits of offshore structures, individuals can navigate complex fiscal landscapes to maximize their wealth growth potential. This approach isn’t just about minimizing taxes; it’s a comprehensive strategy to protect and grow assets over time.

One key aspect is understanding how different jurisdictions offer unique tax advantages. For instance, some countries have favorable tax treaties that can reduce or eliminate double taxation on income earned overseas. Additionally, offshore entities like trusts and foundations can provide asset protection and privacy while offering flexible financial planning options. Efficiently structuring these arrangements can result in significant long-term savings, ensuring a more substantial portion of your wealth grows over time rather than being consumed by taxes.

Offshore tax planning is a powerful strategy for those seeking to build a secure financial future. By understanding and utilizing global opportunities, individuals can maximize their wealth growth potential. Implementing these strategies allows for smarter investment decisions, reduced tax liabilities, and improved financial security. With careful navigation of offshore tax benefits, one can foster sustainable wealth growth, ensuring a robust and protected financial landscape for the long term.