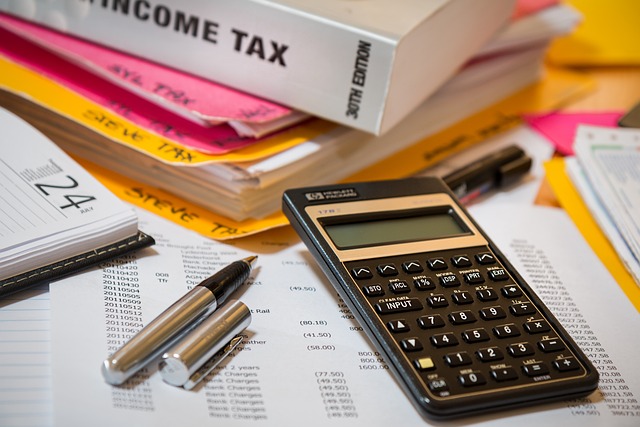

Offshore tax planning empowers individuals and businesses to Build a Secure Financial Future through global tax efficiency. By strategically utilizing legal entities and jurisdictions outside their country of residence, they can legally reduce tax liabilities while optimizing diverse tax regimes for specific income types or foreign-sourced earnings. This frees up funds for growth and investment, enabling significant personal tax reduction and better long-term financial goal achievement. Offshore Tax Planning provides powerful strategies to maximize investment returns by navigating complex international tax laws, utilizing entities like trusts or companies in favorable jurisdictions, and staying informed about fluctuating tax regulations.

“Looking to maximize your returns and build a secure financial future? Consider offshore tax planning as a strategic tool for achieving global tax efficiency. This comprehensive guide delves into the intricacies of understanding offshore tax planning, unlocking opportunities that can significantly enhance your financial outlook. We explore effective strategies to navigate offshore opportunities, ensuring you make informed decisions on your journey towards a prosperous and protected financial future.”

- Understanding Offshore Tax Planning: Unlocking Global Tax Efficiency

- Strategies for Maximizing Returns: Navigating Offshore Opportunities to Build a Secure Financial Future

Understanding Offshore Tax Planning: Unlocking Global Tax Efficiency

Offshore tax planning is a strategic approach to managing your finances, offering individuals and businesses a way to build a secure financial future with global tax efficiency at its core. It involves utilizing legal entities and jurisdictions outside of your country of residence or incorporation to optimize tax liabilities. This isn’t about avoiding taxes but rather legally reducing them through legitimate means, ensuring compliance with international regulations.

By embracing offshore planning, you gain access to diverse tax regimes, each with unique advantages. For instance, certain countries offer favorable rates for specific types of income or provide tax exemptions on foreign-sourced earnings. This enables businesses to structure their operations in a way that minimizes overall tax exposure, freeing up funds for growth and investment. For individuals, it can mean significant savings on personal taxes, allowing them to invest more in retirement plans or other long-term financial goals.

Strategies for Maximizing Returns: Navigating Offshore Opportunities to Build a Secure Financial Future

Maximizing returns on your investments is a key aspect of building a secure financial future, and offshore tax planning can offer powerful strategies to achieve this. By navigating the complex world of international tax laws, investors can unlock opportunities to minimize their tax burden while maximizing their investment growth. One effective approach is utilizing offshore entities, such as trusts or companies, which can provide legal avenues for tax optimization. These structures allow individuals to legally shift income and assets, taking advantage of favorable tax jurisdictions and reducing overall taxable exposure.

Additionally, timing is crucial when exploring offshore opportunities. Tax laws and rates fluctuate across countries, so staying informed about changes in these regulations is essential. Investors should consider consulting experts in offshore tax planning to stay ahead of the curve. By strategically timing their investments and utilizing offshore vehicles, individuals can build a robust financial foundation, ensuring they make the most of their hard-earned money while safeguarding against unexpected tax increases.

Offshore tax planning offers a strategic approach to maximizing returns and building a secure financial future. By understanding and implementing global tax efficiency strategies, individuals can navigate complex financial landscapes and take advantage of diverse offshore opportunities. This article has provided valuable insights into how to unlock these benefits, ensuring a more robust and resilient financial foundation for years to come.