Offshore tax planning is a strategic method for managing finances, aiming to optimize tax efficiency and build a secure financial future. By utilizing global tax laws, individuals and businesses can legally reduce taxable income through entities or accounts in jurisdictions with favorable treatments. This approach offers enhanced control over financial assets, protection from market volatility, and a robust shield against potential risks. A well-planned offshore structure allows for the creation of a tailored global financial strategy, preserving wealth effectively and contributing to long-term financial security. Navigating this complex world requires understanding legal considerations, compliance with international regulations, and specialized advisors to minimize tax liabilities while maximizing returns, ultimately fostering financial security for future generations.

Preserving wealth effectively is a key pillar in building a secure financial future. One powerful strategy gaining traction among savvy investors is offshore tax planning. This article delves into the world of global tax efficiency, exploring how strategic offshore structures can significantly enhance wealth preservation. By understanding the nuances of offshore tax planning, individuals can unlock valuable opportunities to minimize tax liabilities and navigate legal considerations for long-term financial security.

- Understanding Offshore Tax Planning: Unlocking Global Tax Efficiency

- Strategies for Effective Wealth Preservation Through Offshore Structures

- Navigating Legal and Compliance Considerations for Long-Term Financial Security

Understanding Offshore Tax Planning: Unlocking Global Tax Efficiency

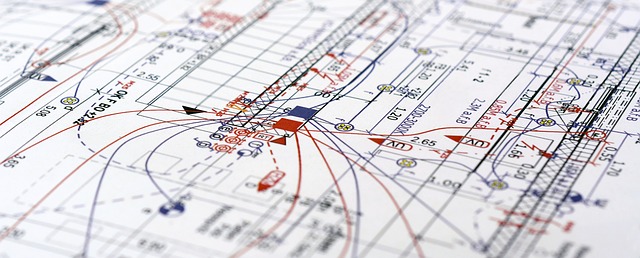

Offshore tax planning is a strategic approach to managing your finances, designed to optimize your tax efficiency and build a secure financial future. By leveraging global tax laws, individuals and businesses can legally reduce their taxable income, resulting in significant cost savings. This strategy involves setting up entities or accounts in jurisdictions with favorable tax treatments, enabling you to legally shift profits from higher-tax regions to lower-tax ones.

It allows for greater control over your financial assets and can help protect them from volatile market conditions and excessive taxation. A well-planned offshore structure can provide a robust shield against potential risks, ensuring your wealth is preserved and worked towards your long-term financial goals. With careful navigation, this method offers an opportunity to build a global financial strategy tailored to your unique needs, ultimately enhancing your overall financial security.

Strategies for Effective Wealth Preservation Through Offshore Structures

Preserving wealth effectively is a key aspect of building a secure financial future, and offshore tax planning offers valuable strategies to achieve this. By leveraging offshore structures, individuals and businesses can mitigate tax liabilities, protect assets, and gain access to diverse investment opportunities. These structures provide legal avenues to optimize tax efficiency while ensuring compliance with international regulations.

One common approach is setting up offshore trusts, which offer privacy and asset protection. Assets held within these trusts can be managed by designated trustees, providing flexibility and control over investments. Additionally, offshore companies allow for the establishment of private foundations, enabling individuals to support charitable causes while reaping tax benefits. This strategic planning ensures that wealth is preserved and can grow over time, contributing to long-term financial security.

Navigating Legal and Compliance Considerations for Long-Term Financial Security

Navigating the complex world of offshore tax planning is a strategic move for individuals seeking to build a secure financial future. This approach involves understanding and adhering to various legal and compliance considerations, ensuring long-term financial stability and growth. By utilizing specialized financial advisors, one can navigate the intricate regulations surrounding offshore investments and structures, thereby minimizing tax liabilities and maximizing returns.

Compliance with international laws and regulations is key. It requires a meticulous process of setting up trust funds, investing in diverse asset classes, and employing tax-efficient strategies. This method allows for the protection of wealth against volatile market conditions and potential legal changes. As such, offshore tax planning serves as a robust framework for preserving and growing assets over time, fostering financial security for future generations.

Offshore tax planning offers a strategic approach to building a secure financial future. By leveraging global tax efficiency, individuals can preserve and grow their wealth while ensuring compliance with legal considerations. Understanding these strategies enables informed decision-making, allowing for long-term financial security and peace of mind. Implement these tactics wisely, and you’ll be well on your way to navigating the complexities of international finance successfully.